For long-term investors, the Federal Reserve plays a key role in supporting the economy and financial system. This will be especially important in 2026 since Jerome Powell's term as Fed Chair ends in May, creating an opportunity for the White House to reshape the central bank's leadership and direction. This could have implications for interest rates, the stock market, and portfolios.

While headlines often focus on the Fed's next rate decision, much of the debate on both Wall Street and in Washington is around what the Fed’s role should be. The Fed’s mandate has evolved over time in response to financial crises and business cycle trends. For many investors, this can be a controversial topic, with natural disagreements over the scope of the Fed’s authority and what policy actions it should take today on interest rates and the money supply.

Looking ahead into next year, these topics matter because they shape not just near-term policy decisions, but the future of the Fed itself. What context do investors need as Fed headlines dominate the news in the coming months?

The Fed's role has expanded over history

The Federal Reserve wasn't established until the Federal Reserve Act of 1913, the third attempt at creating a central bank for the United States. The Fed is not a branch of the federal government, nor was it created by the Constitution. So, there are three broad challenges that are often raised when it comes to Fed independence: 1) its responsibilities have expanded significantly over time, 2) Fed officials are not directly elected by voters, and 3) elected politicians often prefer lower interest rates to support economic growth and employment.

When Congress first established the Fed, its primary mission was to prevent bank panics. Throughout the 19th and early 20th centuries, these panics were common and problematic for businesses and everyday Americans alike. The worst crises of that era include the Great Depression, the Panic of 1907, the Panic of 1893, and many more. Typically, these occurred or were made worse when there was a “run on a bank,” a situation in which depositors lost confidence and rushed to withdraw their money, threatening both the bank and the broader financial system.

While economic and financial challenges have not gone away, these particular types of crises are less common today. The Fed is tasked with ensuring that banks have enough capital reserves and, more fundamentally, the Fed also serves as the “lender of last resort.” That is, it acts as a backstop in situations when a panic might occur. Knowing that the Fed is ready and willing to step in can help ensure that the financial system remains stable and that transactions occur in an orderly manner. This was tested most recently during the 2020 pandemic and the 2023 regional bank crisis.

Over the decades, however, the Fed's responsibilities have grown. The Federal Reserve Reform Act of 1977, which was enacted during a period of high inflation and unemployment, directed the central bank to promote "maximum employment, stable prices, and moderate long-term interest rates." The Fed typically focuses on the first two as its "dual mandate,” and sees the third goal as a result of achieving them.

This evolution is often described as “mission creep,” since the Fed is now seen as managing not only banks, financial transactions, and the dollar exchange rate, but the state of the economy as a whole. Right or wrong, this is why there is so much attention placed on each of the Federal Open Market Committee’s (FOMC) interest rate decisions, not only for the path of rates, but for hints as to how the Fed is thinking about the broader economy.

Fed independence involves tradeoffs

Fed officials are appointed by the president and approved by Congress, but are not directly elected by voters. Critics argue that the Fed amounts to an unelected body with enormous economic power that affects all Americans. Proponents argue that the Fed must often make unpopular decisions, including ones that may slow the economy in the short run to preserve growth in the long run. There is truth to both arguments, so maintaining a balanced view can be difficult.

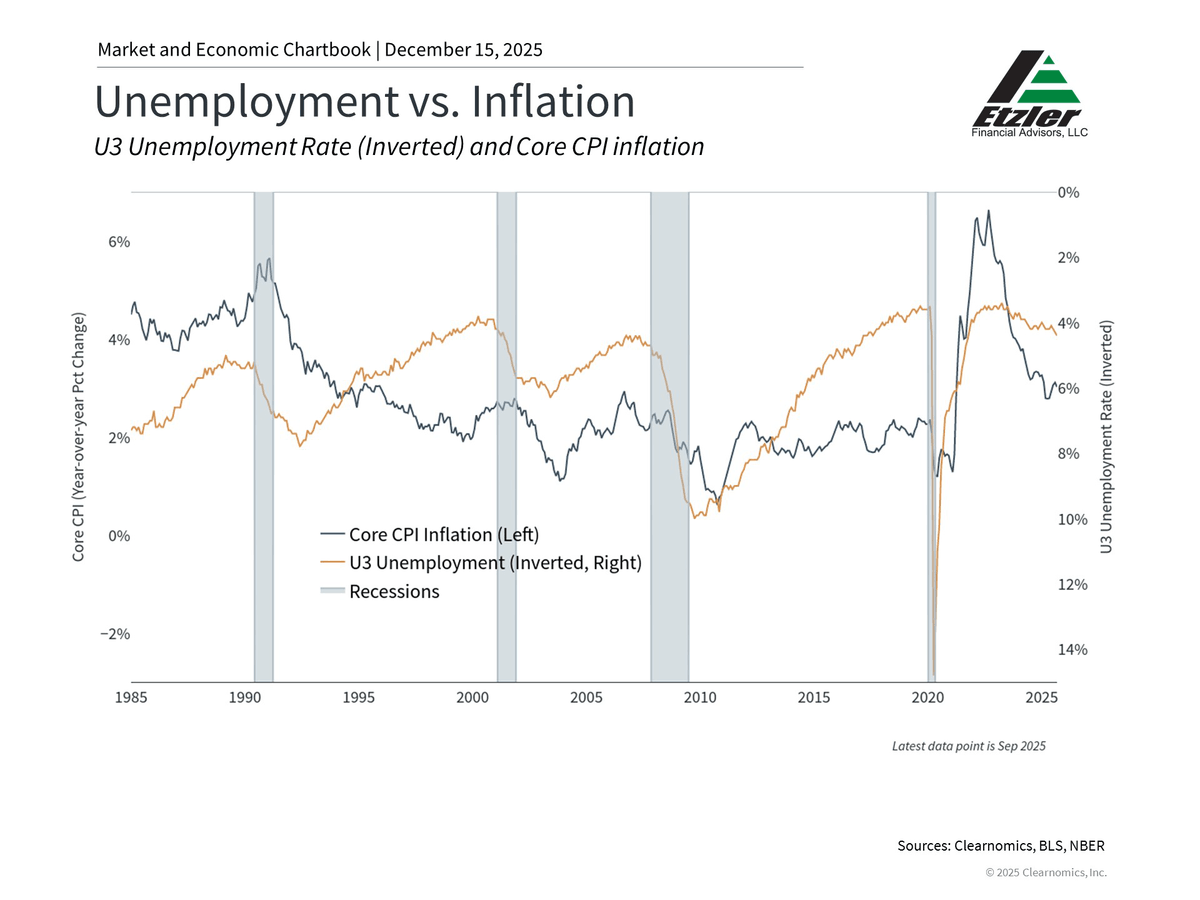

The 1970s and early 1980s typically serve as a positive example of this tradeoff. During that decade, economic shocks and political pressure for easy monetary policy contributed to "stagflation,” the combination of high inflation and high unemployment. Eventually, Fed Chair Paul Volcker raised rates dramatically, causing a recession that eventually broke the stagflationary spiral. This laid the foundation for an independent Fed over the following decades.

Of course, the Fed does not have a crystal ball and is not always correct in its assessments. Former Fed Chair Ben Bernanke famously told the economist Milton Friedman that “you're right, we did it” – referring to poor policy choices that worsened the Great Depression a century ago. More recently, many economists and investors believed the Fed was slow to react to the post-pandemic inflation that began to appear in 2021, thereby requiring sudden interest rate hikes.

Even if the Fed had perfect foresight, its policy tools are limited. The Fed primarily controls short-term interest rates through the federal funds rate. This is often referred to as a “blunt instrument” since adjusting a single policy rate cannot solve many of the underlying challenges in the economy. This includes supply chain problems beginning in 2020 that drove inflation higher, trade uncertainty due to tariffs, or potential labor market challenges due to artificial intelligence.

Additionally, the Fed can only indirectly influence longer-term rates, which matter more for mortgages, corporate borrowing, and investment decisions. These rates are determined by market forces including inflation expectations, fiscal policy, and economic growth. So, while the Fed is often viewed as controlling the economy and financial system, it is often influencing markets or reacting to events rather than driving them.

Leadership changes could shape policy direction in 2026 and beyond

With Fed Chair Jerome Powell's term ending soon, the White House is expected to name a replacement early in 2026. At the moment, the frontrunners include Kevin Warsh, a former Fed governor, and Kevin Hassett, Director of the National Economic Council at the White House. Much could change between now and the final decision, and the frontrunners have shifted in just the past few months.

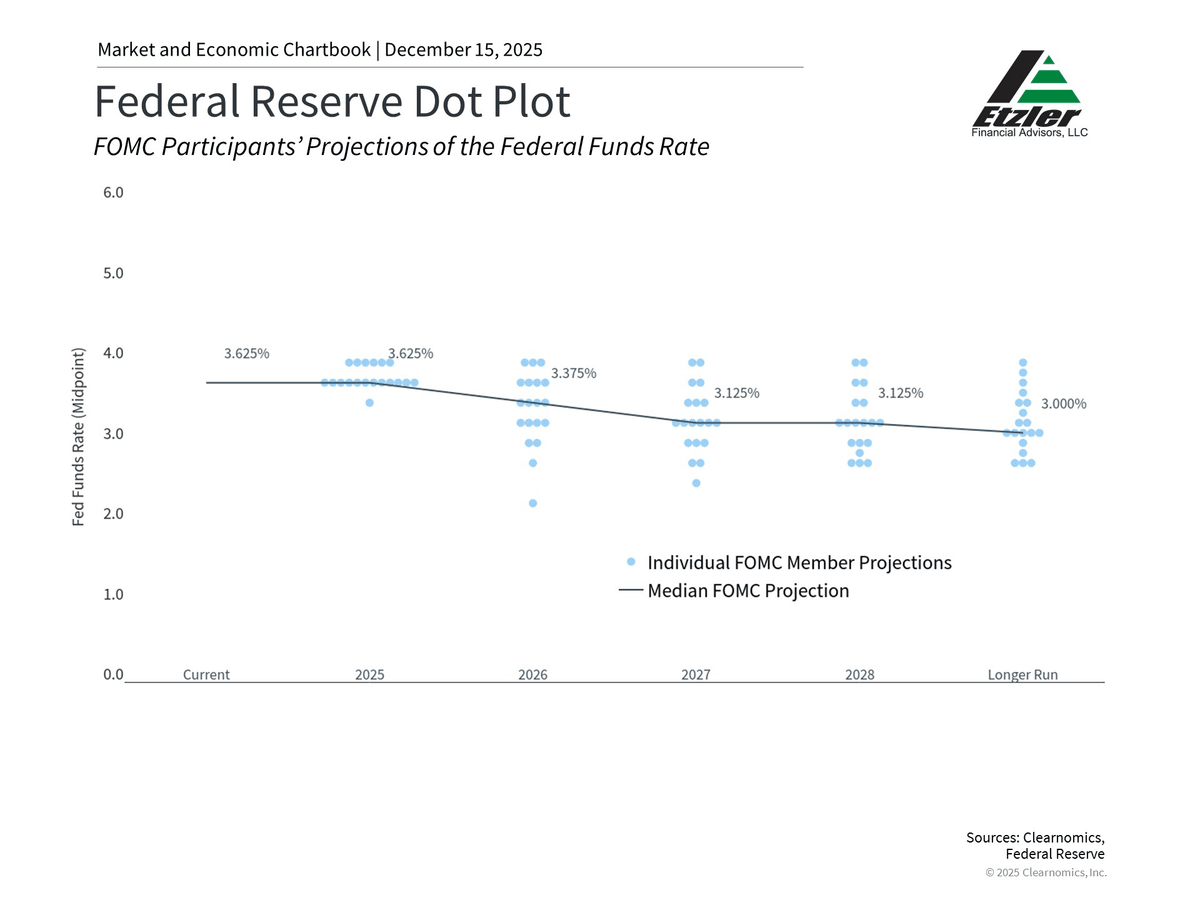

The chart above shows the FOMC’s latest Summary of Economic Projections. These figures suggest the Fed may cut rates only once in each of 2026 and 2027. Regardless of who the next Fed Chair nominee will be, it’s likely that the administration will appoint someone inclined to keep policy rates lower. This means these projections may change in the coming months.

At the same time, it’s important not to overreact to potential changes in policy. While the Fed Chair wields influence over policy direction and represents the FOMC at its press conference, the committee includes twelve voting members with diverse views. This includes the New York Fed President, seven Fed governors, and four regional bank presidents which rotate annually. Historically, the Fed has tried to work toward consensus. So, even a Chair aligned with the administration’s policy goals will need to sway other committee members with economic and policy arguments.

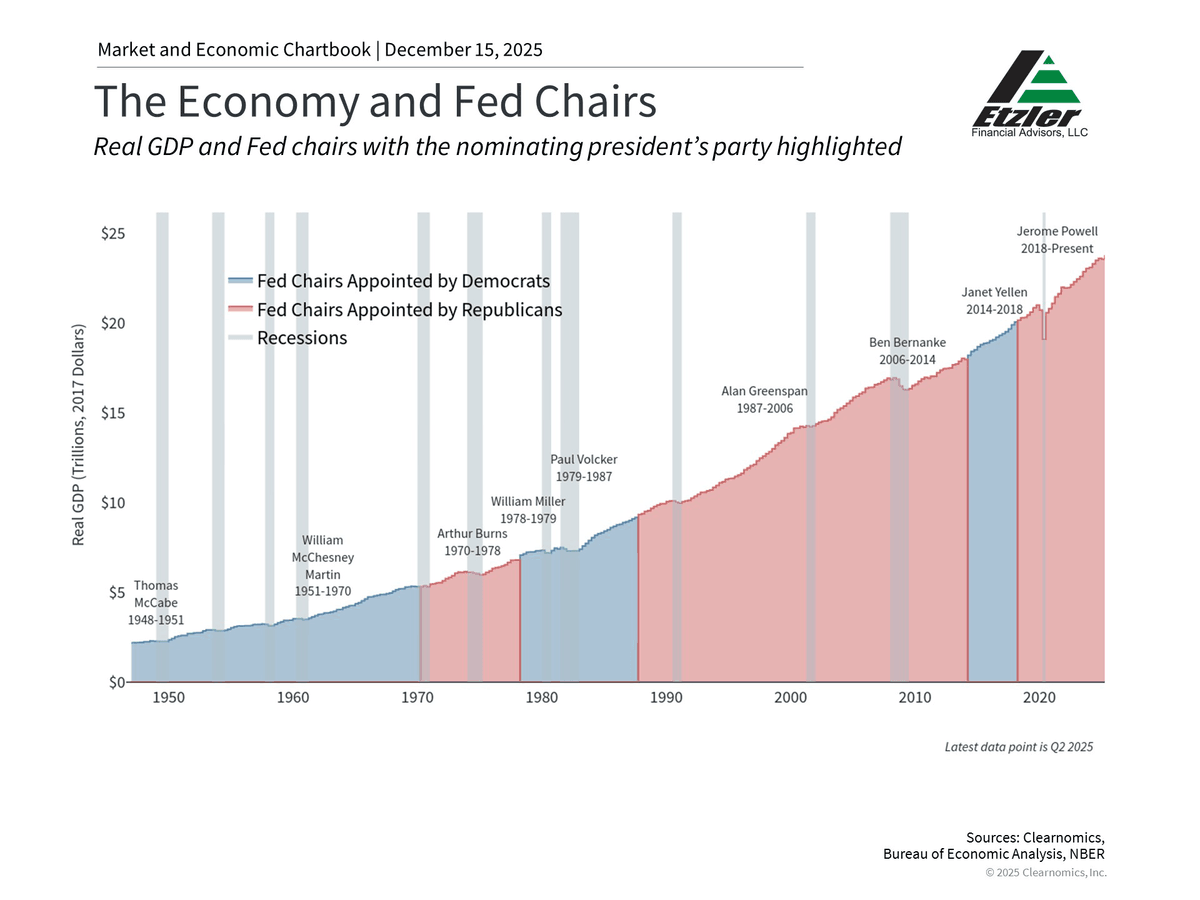

Taking a broader perspective is valuable here since this is not the first time the Fed has changed leadership. The first chart above shows that the economy has grown steadily across different Fed Chairs appointed by both political parties. It’s also important to remember that Jerome Powell was nominated by President Trump during his first term and remained Fed Chair during President Biden’s term.

What matters more than any individual Chair is whether monetary policy remains appropriate for economic conditions. Again, the Fed is often reacting to shocks outside of its control, rather than directly steering the economy.

Economic trends matter more than individual Fed decisions

While there will be many more headlines around Fed leadership in the coming months, what truly matters is the overall path of the economy. The next Fed Chair may generally prefer lower interest rates, but this will depend strongly on whether the job market remains weak and if inflation continues to stabilize. For investors, the key is to maintain a portfolio aligned to financial goals rather than react to the day-to-day speculation around the Fed.