The late Jack Bogle observed that "successful investing is about owning businesses and reaping the huge rewards provided by the dividends and earnings growth of our nation's—and, for that matter, the world's—corporations." This wisdom is relevant today because the benefit of owning stocks is not just about capturing long-run price returns, but also in the dividends corporations pay to investors as they grow their profits.

In today’s environment, the stock market is near all-time highs and dividend yields are near historic lows, estimated at just 1.3% over the next year for the S&P 500. The last time dividend yields were this low was in 2000 during the dot-com bubble. Fed rate cuts and the uncertain interest rate environment also impact how investors can position their portfolios to generate income today.

While dividends are often seen as boring, especially compared to high-flying stocks that attract investor and media attention, the reality is that the role of dividends in portfolios should not be overlooked. Dividend payments compound over time and can provide a steady source of income, especially during periods when stock prices are volatile. Companies that combine both dividend payments and stock prices that rise over long periods (“price appreciation”) can potentially offer investors the best of both worlds: regular cash flow alongside long-term wealth building.

Today's market reflects a decades-long shift in how companies deploy capital and what investors prioritize. How can investors balance both price returns and dividends in their portfolios today?

How investors view dividends has evolved over the past century

The role of dividends in investing has changed over the past hundred years. For much of the 20th century, dividends were a primary source of stock market returns, with yields often exceeding 5 to 7%. Investors purchased stocks much like they might buy bonds today – primarily for the income they generated. Companies were expected to pay and grow their dividends as proof of financial health, and stock price appreciation was often considered secondary to dividend income.

This began to change as investors focused more on technology-driven companies and growth. The dot-com era of the 1990s further reduced the focus on dividends as high-growth technology companies not only reinvested their capital, but were often expected to not pay dividends. Stock buybacks also rose in prominence as a more tax-efficient way of returning shareholder capital than dividends.

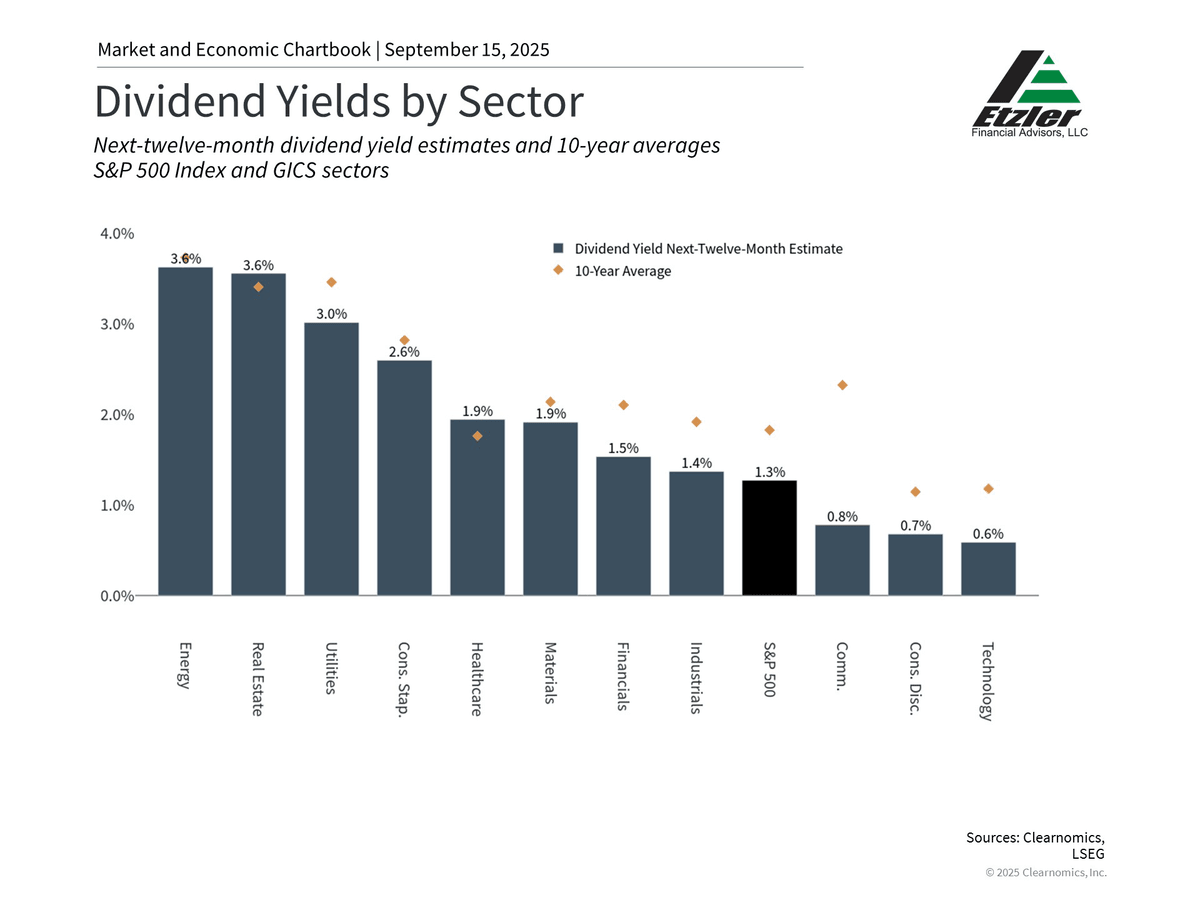

Today's low yields reflect this evolution. As the accompanying chart shows, technology-related sectors such as Information Technology, Consumer Discretionary, and Communication Services offer the lowest dividend yields of 0.6%, 0.7%, and 0.8%, respectively. These sectors include the Magnificent 7 stocks which generally pay lower dividends or none at all.

In contrast, sectors such as Real Estate, Energy, and Utilities that have traditionally focused on income generation offer yields above 3%, showing that higher dividends are available by looking across and within different parts of the market.

This pattern of lower dividend yields for the broader market isn't necessarily a problem since it reflects different market dynamics and business strategies that can benefit investors in unique ways. However, it does highlight the importance of understanding the purpose of dividends for companies, investors, and in portfolios.

Corporate strategy and interest rates affect the attractiveness of dividends

From a company's perspective, profits can be used in two ways: to reinvest in the business or to return cash to shareholders through dividends. In theory, companies should return cash to investors when they already have enough capital for attractive investment opportunities or when their business model is specifically designed to generate income for shareholders, such as REITs (real estate investment trusts).

However, dividends serve a broader purpose beyond simply returning excess cash. Many corporations pay steady dividends to attract investors and signal financial stability, particularly when they can demonstrate consistent growth in these payments over time. This dividend growth serves as an indicator of corporate health and management confidence in future earnings, beyond just income alone.

Interest rates and the Fed's monetary policy also affect the attractiveness of dividend-paying stocks. When Treasury yields exceed dividend yields, they reduce the relative attractiveness of these stocks. Currently, with 10-year Treasury yields around 4.1%, government bonds offer substantially higher income than the overall stock market. As the Fed continues to cut policy rates, this dynamic could shift.

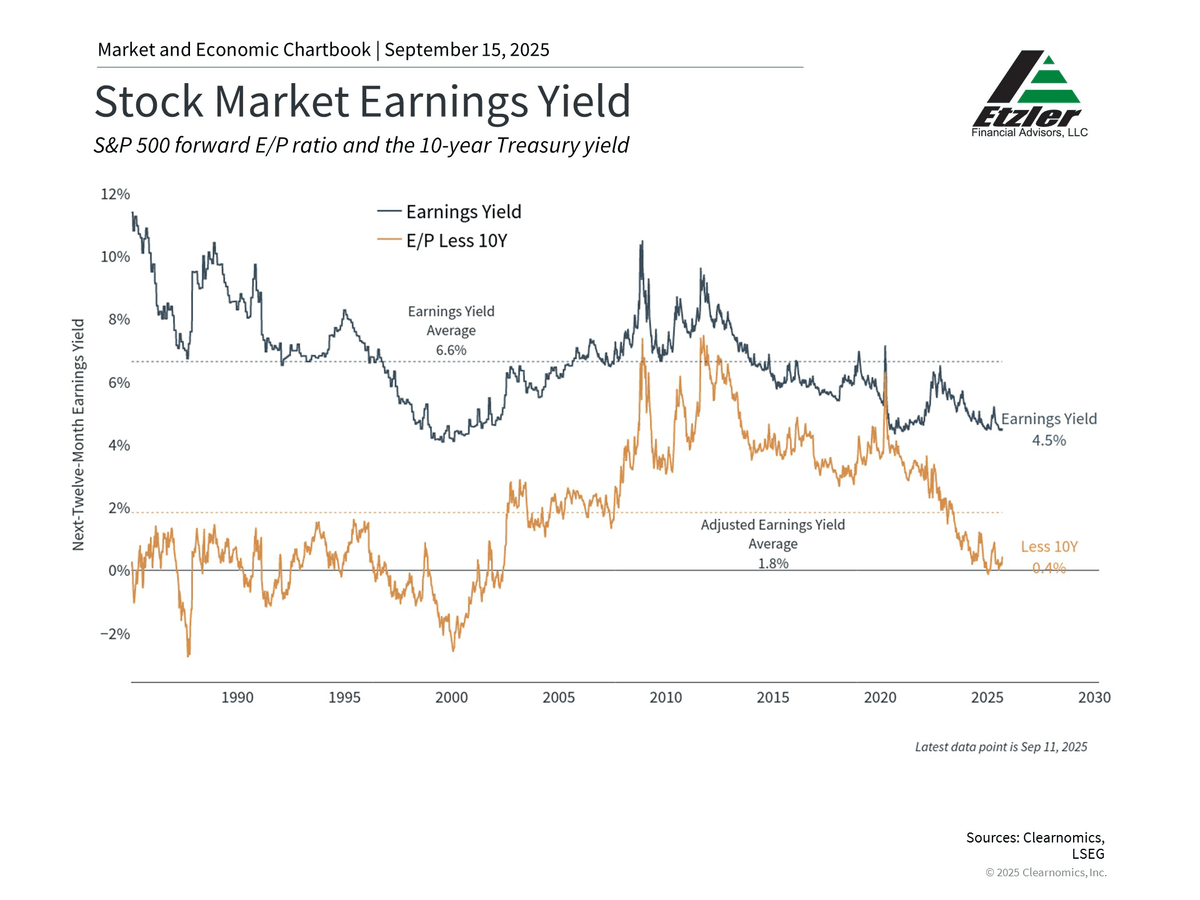

The accompanying chart shows a related concept known as the “earnings yield,” sometimes referred to as the “equity risk premium.” This measures how attractive stocks are compared to Treasurys. This downward trend in recent years is a result of stocks climbing to new highs and higher interest rates. The fact that interest rates have hovered in a range more recently is why the relative earnings yield has stabilized this year.

Dividends are an important consideration for investors

For investors, dividends are an integral part of the total returns generated by a portfolio. According to Standard and Poor's, dividends have contributed 31% of the total return for the S&P 500 since 1926, while price appreciation has contributed 69%.1 Today, everyday investors seem to focus mostly on stock prices except in cases where portfolio income is needed, such as for those nearing or in retirement.

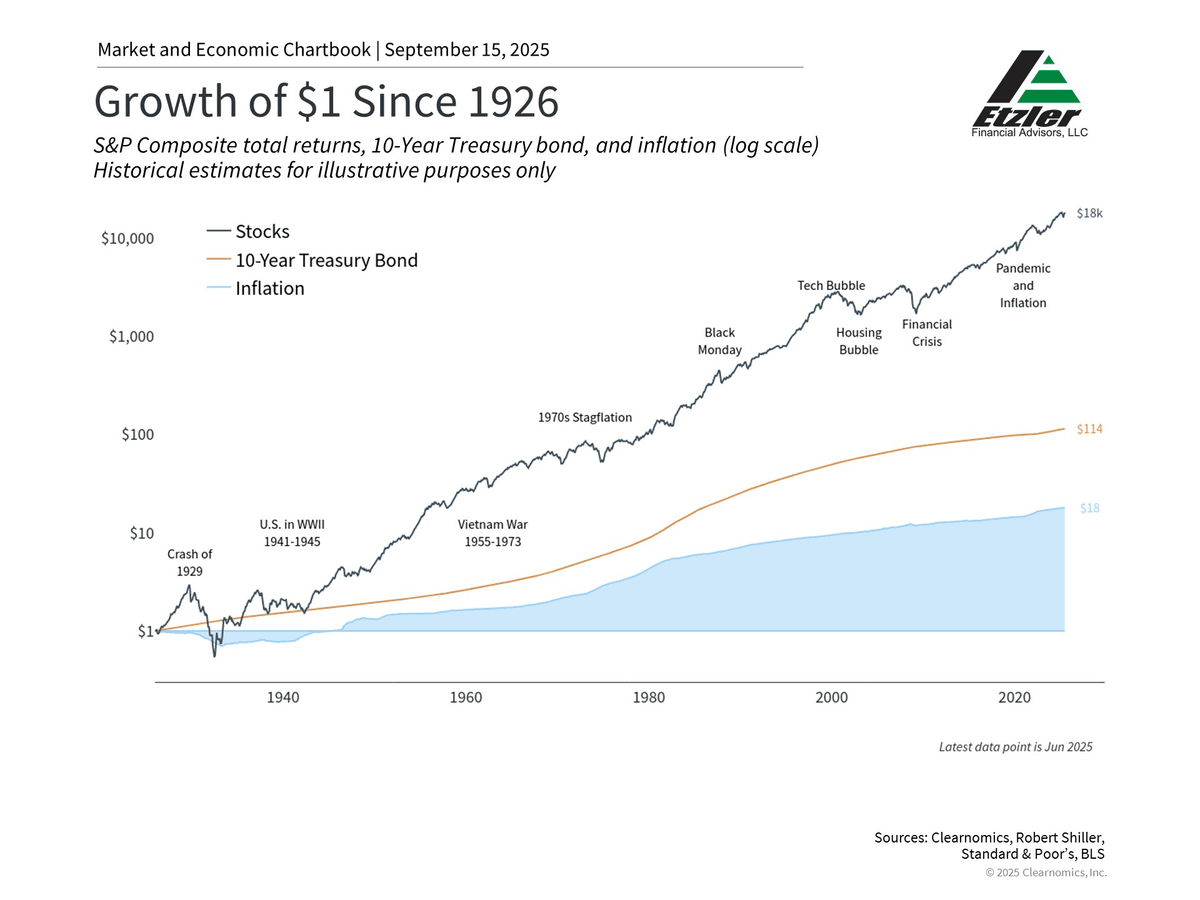

The accompanying chart shows that $1 invested in stocks in 1926 grew to approximately $18,000 by 2025, demonstrating the power of compound growth over long periods. This growth came from both dividends and price appreciation, but the specific mix varied across different time periods. During some decades, dividends provided most of the return. In others, stock price appreciation dominated. What remained constant was the importance of staying invested through various market cycles, regardless of what drove returns.

For investors approaching or in retirement, the focus naturally shifts toward generating current income. However, this doesn't necessarily mean concentrating exclusively on high-dividend stocks. The risk of "yield chasing" – focusing solely on the highest-yielding investments – is that it can lead to poor diversification, concentration in unsustainable companies and industries, and reduced growth for today’s longer retirements.

Thus, investors should find the appropriate balance of dividends and growth for their financial goals. This “total return” approach helps ensure that portfolios can generate appropriate returns through various market environments, whether through dividends, capital appreciation, or both.

While dividend yields are near historic lows, they continue to play an important role in portfolios. Investors should focus on both price appreciation and dividends as they work toward their financial goals.