The challenge facing investors today isn't whether artificial intelligence will transform the economy, but how to maintain portfolio balance as the market climbs to new all-time highs. While it’s tempting to focus exclusively on companies that have performed well recently, investing for long-term goals requires a thoughtful approach to both growth and risk management.

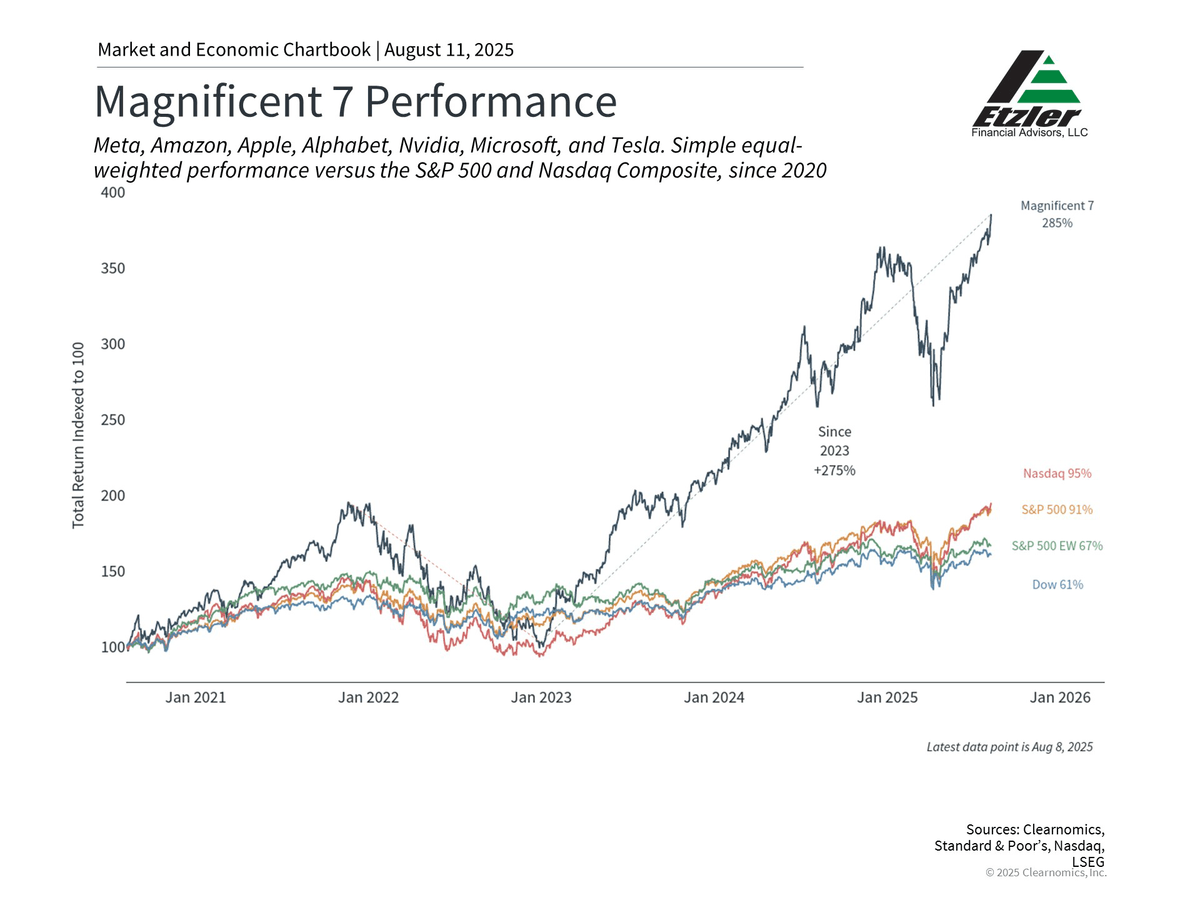

Mega-cap technology stocks, including those benefiting from AI trends, are commonly represented by a group known as the "Magnificent 7." These stocks - Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta, and Tesla - now constitute about 35% of the S&P 500 and represent seven of the eight largest companies. Several are also referred to as “hyperscalers” due to their significant investments in computing infrastructure to meet the growing demands of AI applications.

In market environments like these, when a relatively small group of stocks drives much of the market's performance, it becomes even more important to focus on historical perspectives, current valuations, and asset allocation. Understanding how similar periods of market concentration have played out in the past can help investors make better decisions about their long-term financial plans.

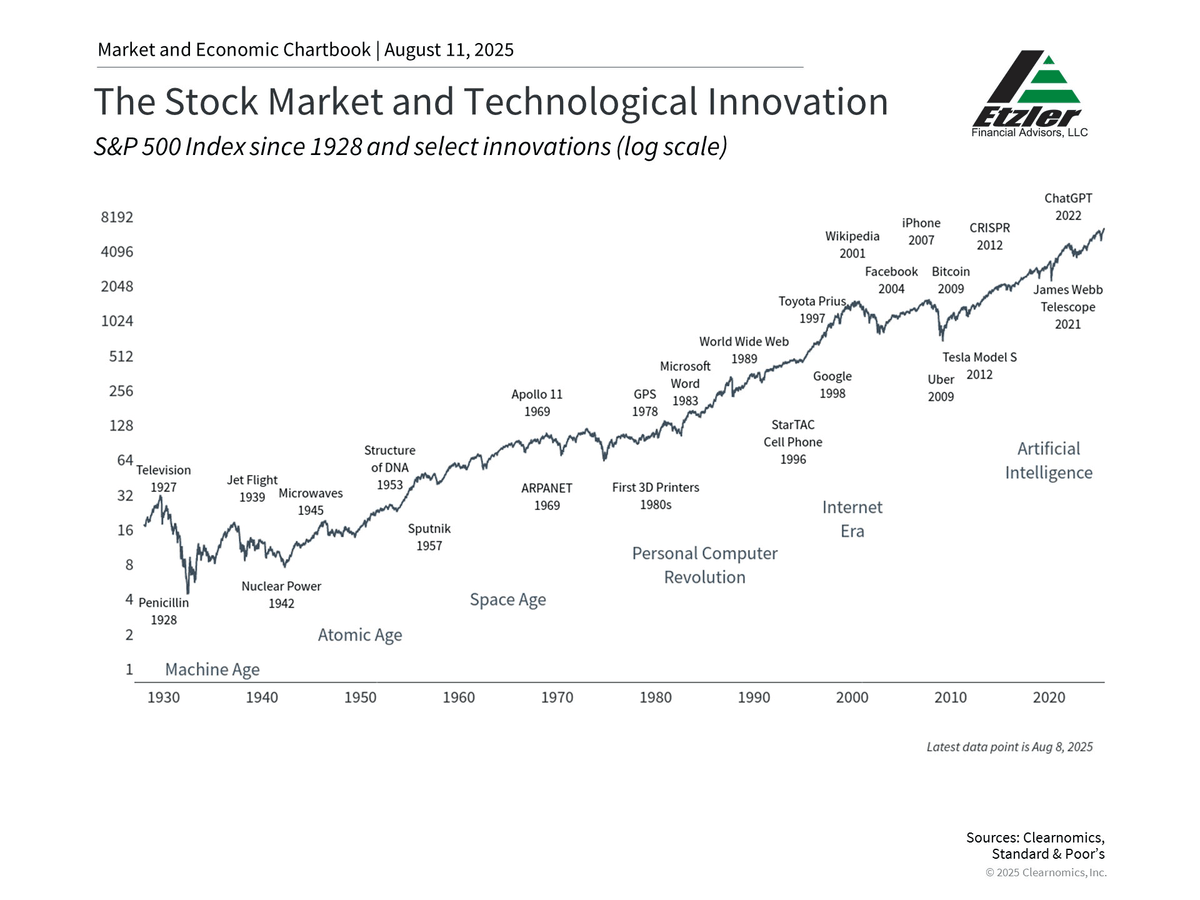

Innovation drives markets in the long run

It may seem as if AI and railroads have little in common, but history shows that transformative technologies often follow similar patterns. In the 1860s, railroad stocks dominated American markets much like technology stocks do today. In fact, the Pennsylvania Railroad company was once the largest company in the world and, alongside other railroads, represented a significant share of the overall stock market. Naturally, this created market enthusiasm and rising valuations that would sound familiar to modern investors.

This pattern has repeated many times across history. The dot-com boom of the 1990s, during which investors focused almost exclusively on internet companies, provides perhaps the clearest recent example. But going as far back as the 19th century, the telegraph, electric power, and telephones transformed cities and created many new companies. In the 20th century, the electronics and computer revolution reshaped all aspects of life and business, even before the invention of the internet.

Each of these waves followed a similar pattern: skepticism, rapid adoption, market enthusiasm, and eventual integration into the broader economy. Railroads didn't disappear but became a standard part of the transportation and shipping industry, supporting the overall economy. While many dot-com companies did fail in the late 1990s and early 2000s, many others went on to become today's technology leaders.

When it comes to long-term investing, it’s important to focus not just on individual companies, but on the impact of new technologies on the broader market and economy. After all, the true impact of innovation is greater productivity and efficiency across all businesses. The key difference is that while the stock prices of individual companies may rise and fall quickly, it takes much longer for the full economy-wide effects to be felt.

History shows that valuations matter as much as growth

Today, the question isn't whether AI will matter, but whether current valuations are reasonable. With the overall S&P 500 trading at a 22.5x price-to-earnings ratio, one that is approaching the all-time high of 24.5x, investors are paying a premium that assumes these trends will continue at the same pace.

What's driving high valuations for the Magnificent 7? First, according to recent estimates, U.S. private AI investment reached $109 billion in 2024, with hundreds of billions more announced this year. This exceeds the entire GDP of many countries and dwarfs similar investments by others. In recent quarters, investors have reacted positively to announcements of ever-higher AI infrastructure spending. This is a significant shift from less than a year ago when investors were worried about whether these investments by large companies would pay off.

Second, many companies and everyday users have rapidly adopted AI tools, creating more and more demand for computing power. This explains why "hyperscalers" like Microsoft and NVIDIA have seen their market capitalizations soar, with both companies reaching valuations over $4 trillion. This is also why demand for new data centers, and the power needed to run them, are top of mind for investors.

These companies are seen as building the infrastructure that allows other businesses to adopt AI technologies, much like railroad companies built the transportation infrastructure that supported all businesses in the 19th century. While this creates enormous long-term value, the timeline for realizing returns is difficult to predict.

The challenge is that markets often overestimate the speed at which transformative technologies will generate profits, even when the long-term potential may be real. The 1990s offer a cautionary parallel. During that decade, some investors believed that traditional valuation metrics no longer applied to internet companies. When reality didn’t meet expectations, the Nasdaq fell 78% from its peak, and many companies failed or were acquired. Yet the internet did transform the economy, just not within the timeline or in the manner that peak valuations implied.

Balancing opportunities with concentration risk

Similarly, while the Magnificent 7 companies may have led the market on the way up, they have also done so on the way down. For example, in 2022 when interest rates rose quickly due to inflation, these stocks dropped about 50% on average.

Since the Magnificent 7 now represents such a large portion of major market indices, the reality is that nearly all investors have these stocks in their portfolios. For those who have focused on technology stocks, their portfolio allocations may be greater than intended.

Holding too much of a portfolio in just a few investments is often known as “concentration risk,” and is the opposite of diversification. On the one hand, these companies have demonstrated growth and profitability. On the other hand, having a large portion of your portfolio dependent on a small group of companies, regardless of how successful they are, can create volatility as trends change. Even great companies can experience periods of underperformance.

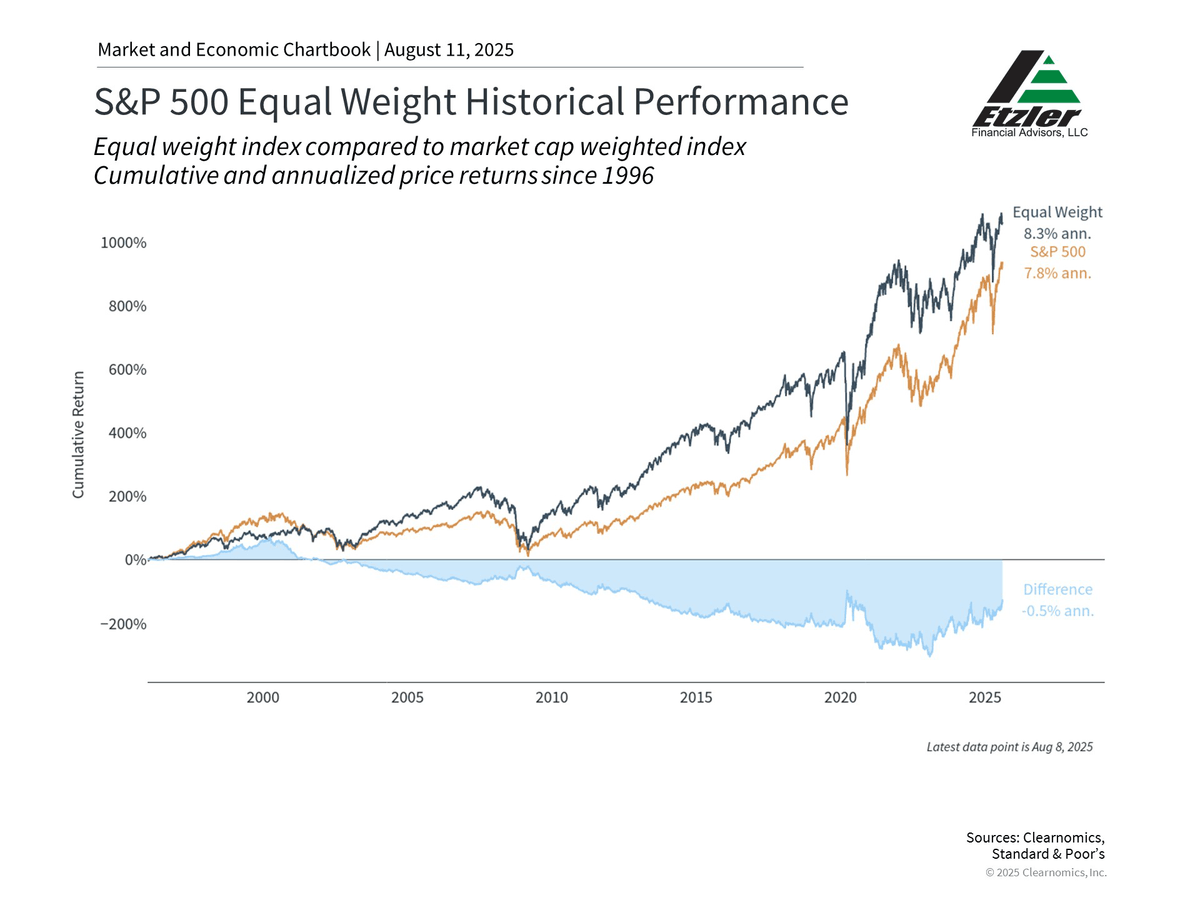

For perspective, consider the equal-weighted S&P 500 shown in the chart above, which gives the same importance to each company regardless of size. This approach has historically provided different return patterns than the standard market-capitalization weighted index, sometimes performing better when large companies struggle.

Since mega cap tech companies have performed well recently, some investors may find it surprising that an equal weighted index has still outperformed over the past 30 years. This highlights the importance of not just focusing on what has driven markets recently and what happens to be in the headlines.

This doesn't mean that investors should avoid technology stocks entirely. Rather, it suggests the importance of maintaining balance and an appropriate asset allocation.

Current AI trends offer both opportunities and risks to investors. Financial success is not about picking winning stocks, but maintaining an appropriate portfolio balance aligned with long-term goals.