As many asset classes have reached new peaks, gold has also climbed over 60% this year to above $4,300 per ounce. This rally has captured headlines and prompted many investors to wonder if it is different from past episodes.

This has been referred to as the "debasement trade," based on the idea that governments have incentives to weaken their currencies through deficit spending and accommodative monetary policy. This, along with the weaker dollar, have led some investors to favor assets like gold that are viewed as a "store of value," especially as stock market volatility has risen again.

While there are legitimate concerns about fiscal deficits, history shows that predicting the path of gold prices is difficult, and there are other factors driving the market rally beyond currencies and interest rates. For long-term investors, the challenge isn't whether to own stocks and bonds versus gold, but rather how much of each asset class should be held in a well-constructed portfolio.

Perhaps most importantly, it's critical to understand the difference between short-term speculation and long-term financial considerations such as income and growth, especially when an asset has already experienced a rally.

A brief history of currency debasement

Even though the concept of currency debasement is thousands of years old, it is a concern that resurfaces every few years. The literal definition of "debasement" refers to the act of governments reducing the precious metal content in coins. This historically allowed governments to mint more coins from the same amount of precious metal, but in doing so, reduced the purchasing power of each coin.

In modern times, most currencies are known as "fiat currencies" since their values are based on trust in the governments that issue them, rather than being backed by gold or other precious metals. So, today's debasement concerns center on whether governments will permit higher levels of inflation and a weaker currency, since this would make it easier to manage their existing debt burdens.

This is closely related to other ideas that gained prominence after the 2008 financial crisis. The economists Reinhart and Rogoff, for instance, documented what they referred to as "financial repression" - policies that keep interest rates artificially low to reduce the real cost of government debt. This hurts savers since the value of cash would fall if interest rates cannot keep up with inflation. With the national debt continuing to rise, it's no surprise that some investors are worried about these policies and thus seek to hold assets that can retain their value.

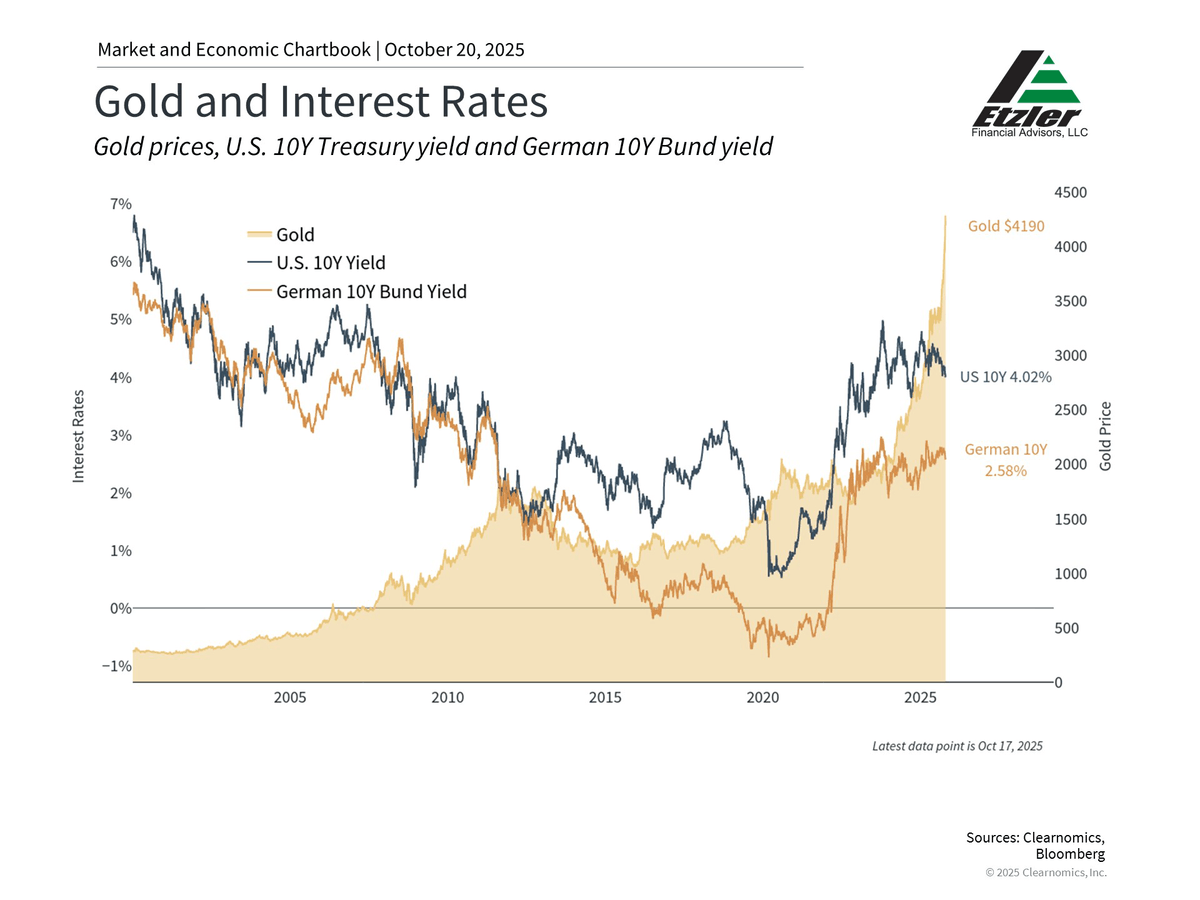

Even if these are long-term concerns, there is conflicting evidence over whether this is occurring today. First, inflation rates have remained stubborn but are not extreme. For instance, the Consumer Price Index, the Personal Consumption Expenditures Index, and the Producer Price Index are all at 3% or lower. Second, the bond market is also not pricing in high levels of inflation. In fact, the 10-year Treasury yield has declined in recent weeks to 4% or less, and the inflation rate implied by Treasury Inflation-Protected Securities (TIPS) is only 2.3%.

Two other factors are important to note. First, central banks around the world have been buying gold in order to shore up their reserves. This has accelerated due to geopolitical uncertainty and the weakening dollar. Second, while the value of the dollar has declined about 10% this year, it is still at the high end of its range over the past twenty years. In other words, from a long-term perspective, the dollar is still quite strong relative to history.

Gold rallies are difficult to predict

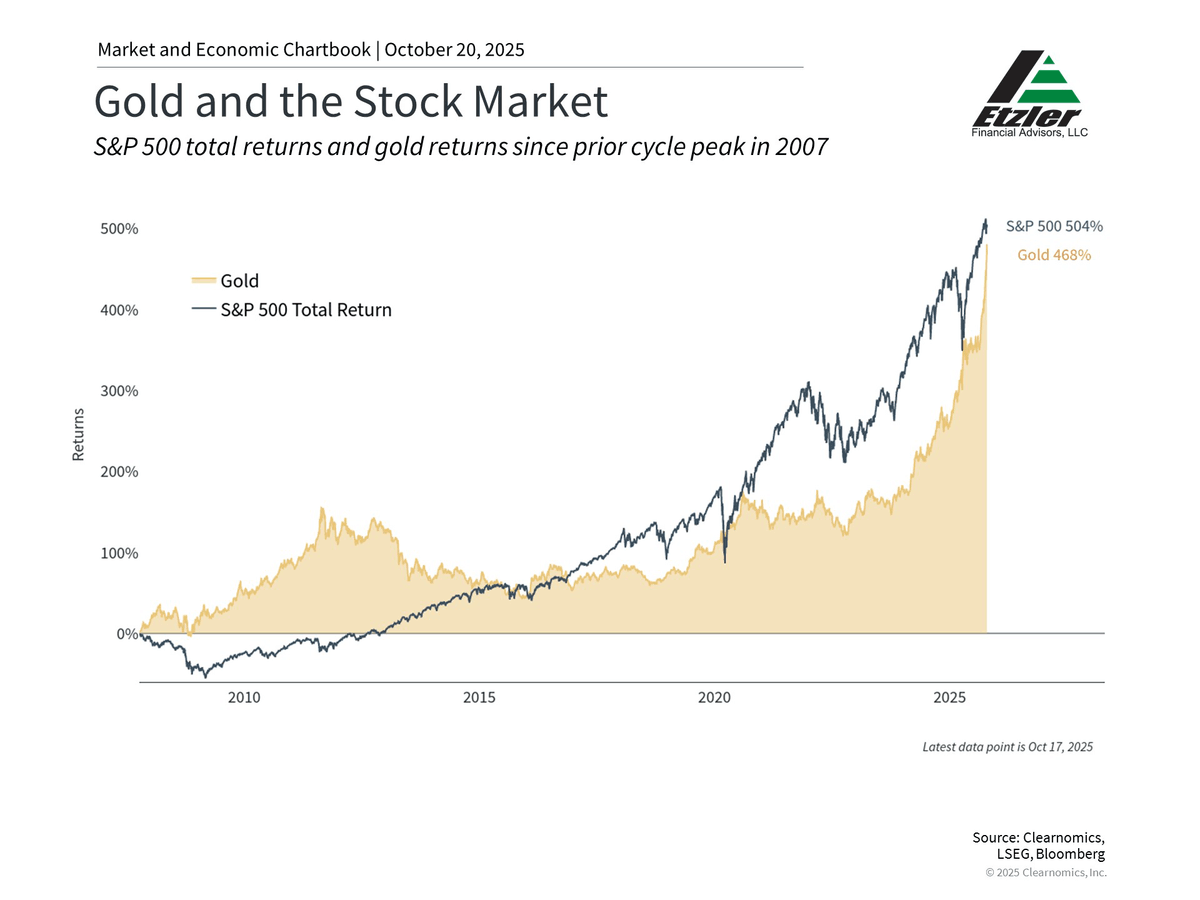

As a speculative asset, it's understandable that gold tends to capture the attention of investors. Over the past several decades, gold has experienced dramatic rallies with mixed results. In the late 1970s, gold surged as investors worried about stagflation and Fed independence. Its price peaked above $800 in 1980 - a level it wouldn't reach again until 2007.

A similar pattern occurred after the 2008 financial crisis when central banks poured stimulus into the financial system. At the time, many investors justifiably worried about runaway inflation and the collapse of the dollar, neither of which occurred. Gold doubled from 2009 to 2011, reaching about $1,900 per ounce, before falling back toward $1,000 over the next few years. This was the case even though the Fed did not begin to reduce stimulus measures until 2013, or raise rates off the zero lower bound until 2015.

The accompanying chart shows gold's performance compared to the S&P 500 since the market peak in 2007. While gold has had periods of strong performance that create diversification benefits, the S&P 500 has still outperformed over the full period. For investors focused on the daily swings in the stock market, this fact may seem surprising. Once again, this speaks to the need to view all asset classes from a portfolio perspective.

Many asset classes have contributed to portfolio returns this year

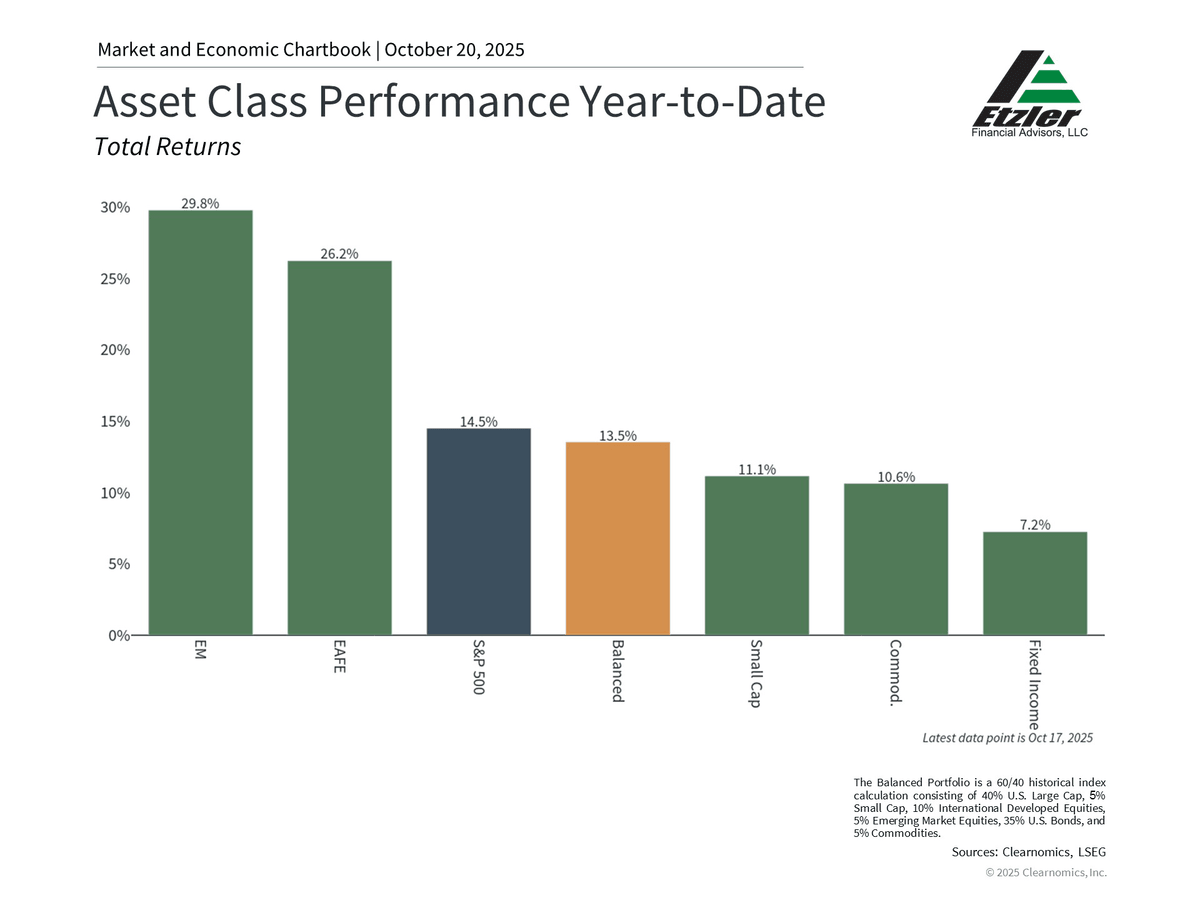

The current gold rally, which began in 2024, is intertwined with strong performance across many assets, including artificial intelligence stocks, such as the Magnificent 7, international stocks, bonds, and cryptocurrencies. The accompanying chart shows that many asset classes have contributed to portfolio returns this year. While gold has certainly performed well, there will always be individual stocks and other assets that perform well in a particular year.

For many investors, gold plays a role as part of a broader commodities allocation, possibly related to other alternative asset classes. The Bloomberg Commodity Index, for instance, began the year with a 14.3% target weight in gold. Together with other commodities such as silver, industrial metals, energy, grains, and more, this index has gained 10.6% year-to-date.

There are other reasons to favor holding many different asset classes that are aligned toward long-term financial goals. One classic challenge is that gold generates no income, unlike bonds or dividend-paying stocks. So, a portfolio inappropriately weighted toward gold sacrifices the longer-term growth potential of stocks and the income of bonds.

Some investors are concerned by the debasement of the dollar, especially as gold continues to rally. Investors should view gold as one component of a broader portfolio that is aligned with long-term financial goals.