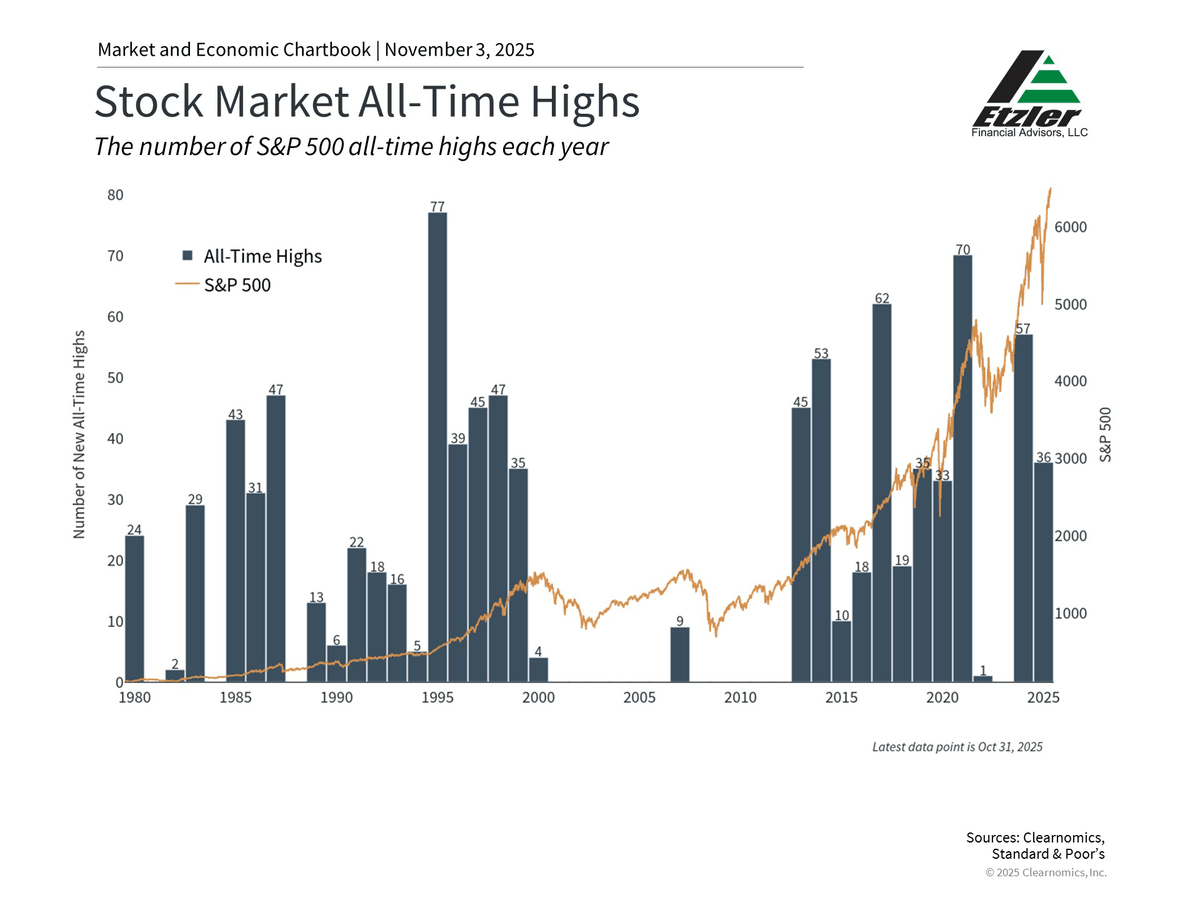

The stock market continued its strong performance in October despite uncertainty from a government shutdown and renewed trade tensions with China early in the month. Many major indices reached new all-time highs after recovering from a brief period of volatility. Bonds also contributed positively to portfolios as interest rates declined, fueled partly by the Federal Reserve's second consecutive rate cut.

Despite positive gains, the month was not without challenges. The ongoing government shutdown captured headlines and raised recession concerns, while a brief "tariff tantrum" over rare earth metals caused the largest single-day market decline since April. However, markets quickly recovered, reinforcing the importance of not overreacting to headlines. These market dynamics also pushed gold to a new all-time high, before pulling back toward the end of the month.

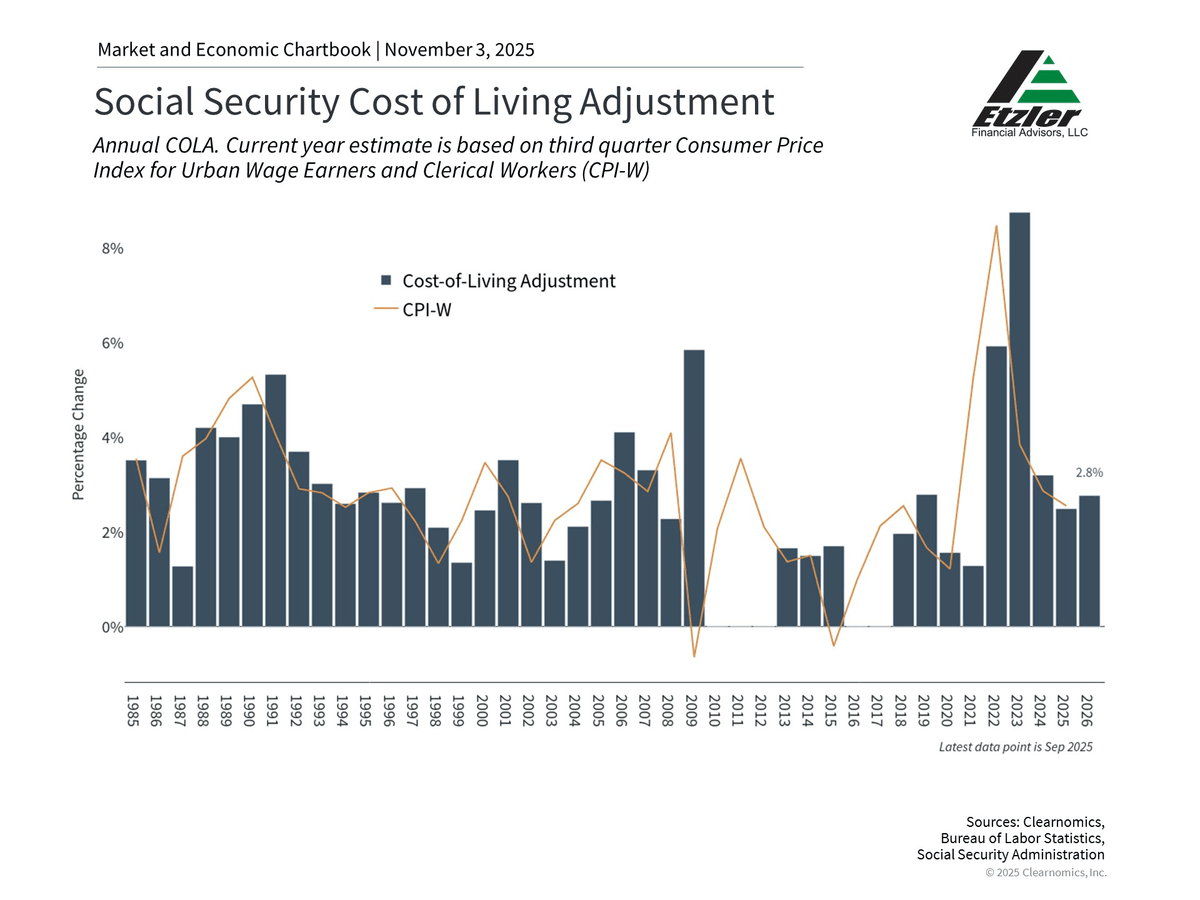

The Social Security Administration announced a 2.8% cost-of-living adjustment for 2026, a modest increase compared to recent years that may not keep up with the rising expenses that many retirees face. Combined with falling interest rates on cash holdings, this underscores the importance of balanced portfolios that provide both income and growth.

Despite these market swings, October's performance reinforces that maintaining a portfolio aligned with long-term goals remains the best approach to navigating uncertainty.

Key Market and Economic Drivers

- The S&P 500 rose 2.3% in October, the Dow Jones Industrial Average 2.5%, and the Nasdaq 4.7%. Year-to-date, the S&P 500 is up 16.3%, the Dow is up 11.8%, and the Nasdaq is up 22.9%.

- The Bloomberg U.S. Aggregate Bond Index gained 0.6% in October. The 10-year Treasury yield ended the month lower at 4.08%.

- International developed markets gained 1.1% in U.S. dollar terms using the MSCI EAFE index, while emerging markets jumped 4.1% based on the MSCI EM index. Year-to-date, the MSCI EAFE index has gained 23.7% and the MSCI EM index 30.3%.

- The U.S. dollar index stabilized and rose slightly to 99.8.

- Bitcoin fell somewhat in October, ending the month at $109,428.

- Gold prices ended the month lower at $3,997, after reaching a new all-time high of $4,336 earlier in the month.

- The Consumer Price Index was reported late due to the government shutdown, but showed that prices rose 3.0% on a year-over-year basis in September. This report is used to calculate the Social Security cost-of-living adjustment (COLA), which will be 2.8% in 2026.

- Other economic data, such as the monthly jobs report, has been delayed due to the government shutdown.

Markets were unfazed by the government shutdown

October began with the government shutdown, which is now approaching the longest on record. This occurs when Congress is unable to agree on a new budget or a plan to extend the deadline. Many agencies, including those that provide timely economic reports, have been operating at minimal levels since then.

While the shutdown creates hardships for many federal workers and their families, it’s important to maintain perspective when it comes to our portfolios. Historically, government shutdowns have not had lasting effects on financial markets since government spending is typically postponed, rather than lost entirely. The longest previous shutdown lasted 35 days during 2018 to 2019, yet the S&P 500 went on to gain 31.5% in 2019. There is no guarantee this will happen again, but it’s a reminder that markets often look past these events.

There are also concerns around government layoffs, known as reductions in force. From the perspective of the broader economy, federal government employment represents only 1.8% of the total workforce, and recent reduction-in-force notices amount to just 0.002% of total U.S. employment. While the shutdown creates real difficulties for affected workers and interrupts government services, its overall economic impact remains limited.

Trade tensions created brief volatility

The market also experienced its sharpest one-day decline since April, driven by escalating tensions between the U.S. and China over rare earth metals, and the threat of 100% tariffs on Chinese goods. Rare earth metals represent one of China's greatest points of leverage in trade discussions. China controls approximately 70% of global rare earth production and nearly 90% of processing capacity, creating significant supply chain dependence.

Despite the brief selloff, markets quickly recovered following softer language from the White House. Presidents Trump and Xi then met near the end of the month, which resulted in a deescalation and a 10% decline in the tariffs imposed on China.

This pattern has repeated throughout the year, with trade-related concerns causing temporary pullbacks followed by a market recovery. Specifically, the S&P 500 has risen 37% from its April low and has set 36 new all-time highs this year through October. Of course, the market never moves up in a straight line, so this is a reminder that short periods of market volatility are normal and expected.

The Fed continues its easing cycle

At its October meeting, the Federal Reserve lowered interest rates by 0.25% to a range of 3.75% to 4.00%, marking its second consecutive rate cut. This decision reflects the Fed's efforts to support economic growth while navigating inflation and a weakening labor market. In its statement, the Fed noted that "uncertainty about the economic outlook remains elevated" and that "downside risks to employment rose in recent months."

Market expectations suggest another rate cut is likely by January, with one or two additional rate cuts in 2026. Beyond policy rates, the Fed also announced it would stop shrinking its balance sheet in December. This means they would continue to buy bonds, effectively maintaining supportive monetary policy. Over the past three years, the Fed has tightened policy by reducing its balance sheet by $2.2 trillion, so ending this process provides additional economic support. For investors, declining interest rates and supportive monetary policy have historically created opportunities across asset classes.

Retirees face challenges from modest COLA and lower rates

The Social Security Administration announced a 2.8% cost-of-living adjustment (COLA) for 2026, reflecting continued but slowing inflation. For the average Social Security beneficiary, the monthly benefit will be about $2,064, an increase of only $56. While any increase helps, this modest adjustment pales in comparison to the 8.7% increase in 2023, which was the largest since 1981.

The challenge for retirees is that the COLA is calculated using an index that may not reflect the inflation that they actually experience. Healthcare costs, housing expenses, and other categories that weigh heavily in retiree budgets have often risen faster than the overall index. For example, medical care services rose 3.9% over the past year, health insurance increased 4.2%, and home insurance climbed 7.5%. Food prices increased 3.1%, but meat, poultry, and fish rose 6.0%.

With life expectancies continuing to increase—many retirees will live into their 90s—planning for multi-decade retirement periods requires portfolios that can provide both income and growth. Understanding how to structure portfolios for these extended timeframes, while managing withdrawal rates and adapting to changing market conditions, underscores the value of comprehensive financial planning.

Despite government shutdowns, trade tensions, and other uncertainties, markets continued their strong performance in October. Maintaining a portfolio that can navigate these challenges remains the best strategy as we approach the end of the year.